Are you receiving our GMM newsletter? Subscribe today.

TRANSFORMING MINERAL ASSET MANAGEMENT THROUGH TECHNOLOGY AND SECURITY

In an era where technology plays a vital role in every industry, Guardian Mineral Management has emerged as a frontrunner in revolutionizing the management of mineral assets. With a firm commitment to security and compliance, Guardian ensures the utmost confidentiality of clients' sensitive information. By leveraging cutting-edge tools and advanced data analytics, Guardian empowers wealth managers to navigate the realm of mineral assets with ease, offering a seamless and efficient approach that maximizes returns and minimizes risks.

Why do you need your assets managed? For individuals and organizations owning oil & gas or mineral rights (including surface rights), it is imperative to have a team overseeing these assets, particularly one with expertise in various types of mineral rights and land management.

The energy sector is expected to continue shifting significantly over the current and next decade, as machine learning technologies further impact exploration, production, operational logistics, finance, product refinement, distribution, land analysis, and portfolio management.

Six months ago, we dedicated our newsletter to sharing our biggest highlights from the US Energy Information Administration’s (EIA) Annual Outlook Report. Now, we’re delving into the data and environment again to provide you with a progress update.

The oil and gas industry is impacted by complex, interrelated global forces. In our Q2 update, we’re highlighting the major happenings in global energy markets, legislative updates, political maneuverings and production and pricing levels.

Consumer demand for gas has nearly returned to 2019 levels. However, transportation shortages are expected to increase the end consumer price and push levels up to the $3 a gallon for the first time since 2014. Learn how a supply chain snafu is impacting the industry—and your family’s summer plans.

Do you remember the excitement of your first well—or the first new production you managed? A large caravan of trucks rolled in to modify or build access roads to the site. Tractors built storage ponds and roadside billboards displaying permits. Seeing the parade of drilling rig components trucked into town on massive, oversized flatbeds?

The Biden Administration has issued a moratorium on all new oil and gas leases on federal lands—including offshore drilling. Here’s how the industry may be impacted and everything we know about the leasing study.

Every year the US Energy Information Administration (EIA) releases the Annual Outlook Report. This report provides valuable research into domestic and international demand, product projections and models based on GDP growth.

What you need to know about exploring Working Group Partnerships and how you can strengthen your safeguards this year. Learn More

What’s the production status of your wells? How much revenue do you anticipate next summer? In any other industry, these would be simple questions. Oil and Gas is an industry mired in complexity. Each royalty check contains a current month estimate plus potentially two years of ins and outs.

Most mineral and royalty owners are drowning in a sea of paperwork. How can a check as small as $200 create a report that’s two inches thick every month?

Clean energy is surrounded in hype and hope, but what's the best option? The past decade has produced major advancements in wind, solar and hydropower options. But what counts as clean energy and how do our options stack up? Learn more about clean energy options: solar, hydropower, wind and natural gas.

Do you have Big Oil shares in your investment portfolio? Looking at Big Oil to gauge how the market is recovering? This month we’re breaking down trends on how Big Oil is protecting shareholder value.

Getting lost in Oil and Gas jargon? We've got you covered. Jargon is an important component of culture. It helps people identify with others who share interests, goals or lifestyles—and in business—it helps you identify your sector. While jargon can be challenging for new members, we've got the cheat sheet to help you along your journey.

The recovery is a series of bumps instead of a clean linear pattern. We’re sharing our take on the stages of recovery so that mineral owners can be prepared for the months ahead.

How will the Oil & Gas Industry recover, and when? As a Mineral Management & Consulting firm, we're analyzing the data, watching the market and advising our clients. Here are the variables that support our thinking and what we see for mineral owners.

Does tax season have you drowning in documents? Learn how adopting a mineral management binder this tax season can reduce stress and streamline your management process. Plus, keep an eye out for these critical documents.

Is it possible to structure win-win lease agreements? Yes. We've negotiated thousands of mineral leases for owners, and we're sharing our top lease lessons with you. Strengthen your lease strategy today.

Communication crafts deals, and investing in strong communication pathways is a no-risk investment that can generate dual dividends: financial and relational. Here are a few ideas on how to strengthen communication strategies by identifying silos and applying engagement techniques.

How will the oil and gas industry's changes in Texas, Oklahoma, New Mexico, Louisiana and more impact owners' 2020 mineral owner strategy?

The oil and gas industry is clouded with confusion, corroded by ‘characters’ and rapidly evolving, so we wanted to do our part to infuse more transparency and owner advocacy.

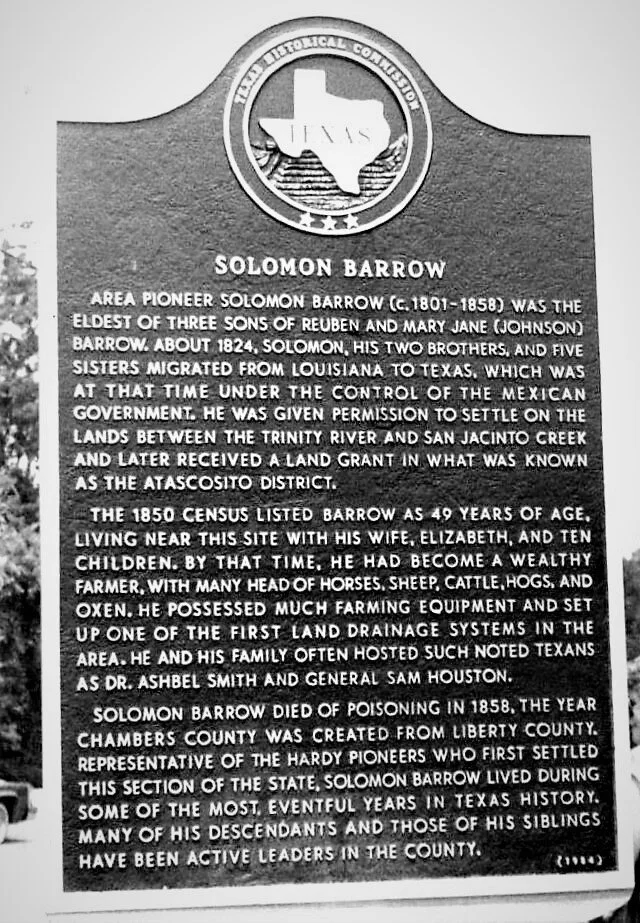

Experts and industry research suggest the next evolution of oil and gas exploration and production has arrived— and it’s use of innovative technology, collaborative working groups and skilled professionals can be found thriving at the historic Barrow Ranch.

The US is expect to increase production of natural gas by 70% by the year 2050. Catch the report's highlights and get our take on how mineral owners can proactively prepare to take advantage of the upcoming opportunities.

Do you have the right team behind you? Oil, gas and mineral owners have choices of how they’d like to be served. So what are your options and how do you find the right fit? We explore popular options and include some questions we recommend asking.

One of the biggest frustrations we hear from owners with oil, gas and mineral assets is a lack of control. They lack the visibility into their accounts to be able to hold operators accountable—or even validate the accuracy of each months payment. Here’s a few of our recommendations for owners looking to strengthen their control this year.

The role that natural gas can play in the future of global energy is inextricably linked to its ability to help address environmental problems. With concerns about air quality and climate change looming large, natural gas offers many potential benefits if it displaces more polluting fuels. This is especially true given limits to how quickly renewable energy options can be scaled up and that cost-effective zero-carbon options can be harder to find in some parts of the energy system. The flexibility that natural gas brings to an energy system can also make it a good fit for the rise of variable renewables such as wind and solar PV.

Forced Pooling procedures developed in Oklahoma over decades, when the oil and gas industry existed in a vertical world. Companies were drilling geological ideas that were almost always relatively small, with the first well being a true exploratory well, and much riskier than today’s horizontal wells. Forced Pooling actually worked pretty well then. Rules of evidence limited testimony as to values to the small area covering the prospect. It resulted in unleased mineral owners and small producers invariably receiving the highest and best compensation paid to anyone within the area of the geological idea. Back then, spacing units were limited in size to an area that could be expected to be drained by one well. Furthermore, I learned early on that Forced Pooling was there primarily to encourage the drilling of that initial exploratory well. It was never intended as a means to take “protection” acreage or development acreage, prior to the exploratory well being drilled.

A new study by ICF International reaffirms the substantial economic benefits provided by natural gas development and use in the United States. The report, produced on behalf of the American Petroleum Institute (API), examines the economic impact of natural gas-related activities and employment in each of the 50 states, as well as the country as a whole.

Groups we hold memberships too or support.

American Association of Professional Landmen www.landman.org

Texas Independent Producers and Royalty Owners www.tipro.org

National Association of Royalty Owners www.naro.org

Women’s Energy Network https://www.womensenergynetwork.org/NorthTexas/